-

Savneet Singh - The Berkshire of Software

Savneet Singh - The Berkshire of SoftwareFrom 🇺🇸 Invest Like the Best with Patrick O'Shaughnessy, published at 2018-03-06 10:30

My guest this week is another in a recent series of people that makes me want to work harder, learn more, and do more for others. His name is Savneet Singh, and he has already accomplished a remarkable amount in the worlds of business and investing. He’s preferred to keep a bit of a low profile, but I’m hoping, for everyone’s sake, to change that a little bit. Savneet has invested in unique things like Spanish real estate, famous startups like Uber, cryptocurrencies before they were cool, and even websites. He founded and built a fintech company. And now, he both a partner at the wide-ranging investment firm CoVenture, with my previous guest Ali Hamed, and the co-founder of Tera Holdings, which is trying to become the Berkshire Hathaway of software companies. To say this conversation is wide-ranging is an understatement. What’s neat is that my favorite parts aren’t even on investing, but are instead on principles for living. Savneet is one of the best people I’ve met in this journey. I’ve had several other conversations with him with shockingly low overlap with the one you are about to hear—a testament to his active and curious mind. I hope you enjoy learning from him as much as I have. For more episodes go to InvestorFieldGuide.com/podcast. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub. Follow Patrick on Twitter at @patrick_oshag Links Referenced Ali Hamed podcast episolde The VERY simple bear case for bitcoin Owl Mountain Books Referenced Buffett: The Making of an American Capitalist The Gorilla Game: Picking Winners in High Technology Show Notes 2:30 – (First Question) – How Savneet started thinking about Spanish real estate. 4:29 – Why Airbnb could be the most impactful and interesting of the companies like this 5:25 – Savneet’s early entrepreneurial ventures 6:42 – His big investing influences 7:02 – Buffett: The Making of an American Capitalist 7:40 – What did Savneet learn in his two years on the sell-side of Wall Street 8:50 – How the financial crisis impacted Savneet 10:11 – The entrepreneurial journey and GBI 11:40 – Savneet’s observations on the FinTech space and investing in it 16:22 – His thoughts on venture capital style investing 18:36 – Transition out of GBI into his partnership with Ali Hamed 22:13 – The impactful things that his parents did for him 23:23 – How Savneet thinks about justice in his life 26:19 – Why value investing struck a chord with Savneet 28:14 – Defining the proper long-term mindset when starting a company 31:21 – Knowing what he knows now, what does he think about Berkshire today 33:22 – The strategy behind Terra and how it came together 35:00 – His checklist for deciding to invest in a firm 41:38 – Why does Savneet think this is the space he wants to remain in for the long-term 44:39 – How they are thinking about pricing a company they invest in 47:03 – Lessons learned in sales and marketing that he can and will bring to the software world 52:05 – What Savneet has learned from Constellation 59:08 – What lessons has Savneet learned about taxes in their company structure 1:02:13 – How they think about capital sourcing 1:05:08 – His balanced view on crypto as an asset class 1:05:18 – The VERY simple bear case for bitcoin 1:09:45 – Savneet shares the Sikh philosophy with Patrick 1:13:21 – A look at Owl Mountain 1:15:59 – The Gorilla Game: Picking Winners in High Technology 1:16:42 – Any other areas that people are underestimating 1:17:22 – Kindest thing anyone has done for Savneet Learn More For more episodes go to InvestorFieldGuide.com/podcast. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub Follow Patrick on twitter at @patrick_oshag

-

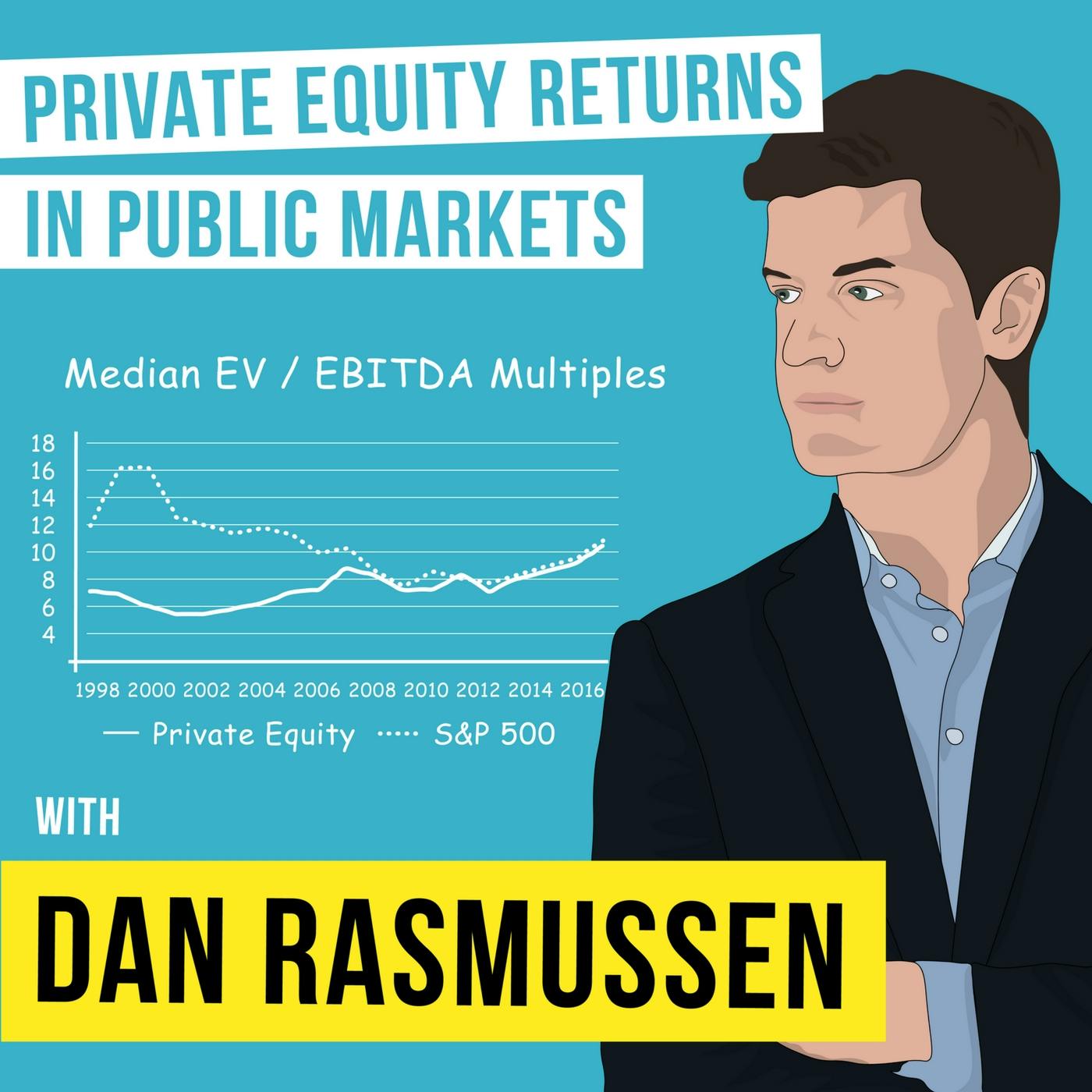

Dan Rasmussen - Private Equity Returns in Public Markets

Dan Rasmussen - Private Equity Returns in Public MarketsFrom 🇺🇸 Invest Like the Best with Patrick O'Shaughnessy, published at 2018-02-27 10:30

It has been a while since we discussed private equity on the show, so I was excited for this week’s conversation. My guest is Dan Rasmussen, the founder of Verdad advisers. Dan worked in private equity and has spent years studying the entire field. Dan identified several key drivers of private equity’s outsized returns: size, value, and leverage. His firm uses these factors as a starting point to build a portfolio of public equities that behave like their private brethren. We cover a ton of ground, discussing the prospective returns for equities, forecasting, and tons of investing strategies. Please enjoy this conversation with Dan Rasmussen. For more episodes go to InvestorFieldGuide.com/podcast. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub. Follow Patrick on Twitter at @patrick_oshag Links Referenced Subscribe to Dan The Gospel According to Michael Porter Tobias Carlisle Steven Pinker E.O. Wilson Books Referenced What Works on Wall Street, Fourth Edition: The Classic Guide to the Best-Performing Investment Strategies of All Time Quantitative Value, + Web Site: A Practitioner's Guide to Automating Intelligent Investment and Eliminating Behavioral Errors Expert Political Judgment: How Good Is It? How Can We Know? Superforecasting: The Art and Science of Prediction Show Notes 2:03 – (First Question) – The current state of private equity investing 4:09 – The three myths of private equity 6:51 – Taking a deeper dive into the myth of growth through operational improvements 9:29 – What Works on Wall Street, Fourth Edition: The Classic Guide to the Best-Performing Investment Strategies of All Time 11:25 – Valuations for private market investment and where they’re going 14:03 – Private equity companies that have a higher chance of delivering results that exceed expectation 16:39 – Other observations on the private equity space that would be interesting to investors considering the asset class 19:33 – Importance of being very purposeful in picking your reference classes 19:42 – Subscribe to Dan 22:03 – How do the lessons Dan has learned in private equity translate to his investment strategies 25:21 – How do you apply purely technical, systematic thinking into public market investing 29:23 – Analyzing leveraged stocks and the value they could create 30:06 – How Dan thinks about the direction of debt vs just the level 33:11 – Predicting a firms ability to deleverage 35:20 – How Dan’s company whittle down a company and are able to see value beyond their quantitative screens 41:29 – How does Dan think about the global vs US opportunity set 44:22 – What originally drew Dan to the Japan market 47:03 – How do rising rates impact Dan’s strategy in investing in highly leveraged companies 55:03 – Porter’s five forces 55:25 - The Gospel According to Michael Porter 1:00:51 – How Dan thinks about competitive advantage 1:04:41 – Exploring Dan’s personal process in pursuit of his ideal strategy 1:05:19 – Quantitative Value, + Web Site: A Practitioner's Guide to Automating Intelligent Investment and Eliminating Behavioral Errors 1:05:20 – Tobias Carlisle 1:06:27 – Steven Pinker 1:06:28 – E.O. Wilson 1:07:11 – What other markets pique Dan’s interest 1:09:39 – Why there is such a focus on small for Dan 1:11:24 – Expert Political Judgment: How Good Is It? How Can We Know? 1:11:28– Superforecasting: The Art and Science of Prediction 1:12:54– What was it like writing the book 1:17:19 – If Dan was going to write another book today, what would it be about 1:19:08– Kindest thing anyone has done for Dan Learn More For more episodes go to InvestorFieldGuide.com/podcast. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub Follow Patrick on twitter at @patrick_oshag

-

Pat Dorsey Returns - The Moat Portfolio

Pat Dorsey Returns - The Moat PortfolioFrom 🇺🇸 Invest Like the Best with Patrick O'Shaughnessy, published at 2018-02-20 10:30

My guest this week, back for a second conversation, is Pat Dorsey. Pat ran equity research at Morningstar before leaving to start his own asset management company: Dorsey Asset Management. His areas of deep interest are competitive advantage and capital allocation. He believes that capital allocation should be in service of competitive advantage and invests in a concentrated portfolio that he and his team feel embody these ideas. If you have not already, I strongly recommend listening to our first conversation, which is a sort of crash course on moats. In this conversation, we cover different ground. We spend much more time on individual stocks like Facebook, Google, and Chegg, using them as examples to explore Pat’s investment philosophy and strategy. Across a few conversations with Pat, I can tell he is in love with this stuff, and I always enjoy talking to investors like him who so passionately pursue and edge. Please enjoy round two with Pat Dorsey. For more episodes go to InvestorFieldGuide.com/podcast. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub. Follow Patrick on Twitter at @patrick_oshag Links Referenced Pat Dorsey's first appearance on the podcast HQ - Live Trivia Game Show Books Referenced World After Capital Principles: Life and Work Show Notes 2:15 – (First Question) – Pat’s methods for valuing a business 4:17 – Is this process done after they would first identify potential targets for investment 5:11 – Pat’s take on how the market classifies stocks as growth vs value 6:40 – Qualitative insights and why the market can’t price them very accurately 9:57 – The business model behind zero marginal cost distribution business model 12:00 – Network effects and the potential downside to them down the road 13:54 – Valuing Facebook as a business heavily reliant on network effects 16:45 – What would have to change for Pat’s position on Facebook to radically change 18:58 – Most important lessons that a smaller/private business could learn from Facebook or Google’s business models 19:48 – Where is Amazon in Pat’s portfolio 22:06 – An example of where primary research led to a big surprise about a company 24:05 – The value of travel in this business, starting with recent travel to India 26:05 – Why are they targeting India and Japan 27:24 – How does he think about the risk of investing in foreign markets 29:52 – His thinking on relative vs absolute market share 31:26 – Exploring the SaaS business model 34:35 – The application of moats and pricing power with SaaS businesses 34:36 – Pat Dorsey's first appearance on the podcast 40:07 – Other models that Pat explores and how to screen for them 41:37 – How does he parse the difference between attention and demand 43:19 – How would Pat monetize something like HQ - Live Trivia Game Show that has aggregated massive amount of attention 45:19 – How does Pat react to the idea that attention is scarce and human capital is so crucial 45:14 – World After Capital 47:04 – How does Pat evaluate human capital in a business 48:09 – Experience in starting an asset management business 50:20 – What are the levers that are biggest value drivers in the asset management business 53:57 – Pat’s view on the strength of the relationship between risk and return 57:06 – The most risk Pat has taken in the face of uncertainty 59:23 – Favorite recent learning resource 59:43 – Principles: Life and Work Learn More For more episodes go to InvestorFieldGuide.com/podcast. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub Follow Patrick on twitter at @patrick_oshag

-

Josh Wolfe - This is Who You Are Up Against

Josh Wolfe - This is Who You Are Up AgainstFrom 🇺🇸 Invest Like the Best with Patrick O'Shaughnessy, published at 2018-02-13 10:30

Long-time listeners will have heard me joke before that this podcast should really be called “this is who are you up against.” I’ve been waiting for the right episode to deploy the joke as a title, and this week we have it. The joke is meant to convey how incredibly impressive these people are who we get to hear from every week. My guest this week is Josh Wolfe, a founding and managing partner at Lux Capital in New York City. Lux is a venture capital firm, but a highly unique one. They’ve spent more time in hard sciences and interesting nooks and crannies of the market than the typical VC firm. Some of investing is zero sum: my outperformance is someone else’s underperformance. Sometimes, though, investing is positive sum. The combination of capital, ideas, people, drive, and raw energy leads to amazing new things. I think the best investing and best investors of the future will be more collaborative than competitive. After finishing with Josh, I couldn’t stop thinking “god, do I want to be involved with whatever he’s doing, if only just to learn.” This conversation made me rethink my joke “this is who are you up against.” Now I won’t think of it as a zero-sum joke, but instead as a reminder: this is the kind of person who is out there. You better find your niche, and still be the absolute best you can within that niche. Please enjoy this killer conversation with Josh Wolfe. We cover just about everything. For more episodes go to InvestorFieldGuide.com/podcast. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub. Follow Patrick on Twitter at @patrick_oshag Links Referenced Investing in Biofuels or Biofools? Ali Hamed podcast Alex Moazed podcast Andy Rachleff podcast Popplet @wolfejosh Books Referenced Modern Monopolies: What It Takes to Dominate the 21st Century Economy World After Capital Show Notes 2:35 – (First Question) – Lux Capital and the kind of investments they have made over the years 5:42 – The formation of the investment philosophy for Lux 9:52 – Investment philosophy 100-0-100 (ambition, arrogance, intellectual humility) 10:40 – How Josh manages his time and attention 12:53 – Investing in Biofuels or Biofools? 13:29 – Obsession with nuclear 18:28 – Focus on autonomous vehicles 21:02 – How all of these gambles are viewed by Josh’s investors 22:56 – Tattoo technology 24:20 – Ali Hamed podcast 24:36 – How Josh evaluates people when considering early stage investments 24:45 – Alex Moazed podcast 24:49 – Modern Monopolies: What It Takes to Dominate the 21st Century Economy 29:50 – Memorable experience investing in a founder 30:44 – The idea of thesis driven approach to private investment 30:56 – Andy Rachleff podcast 32:38 – Crazy thesis – understanding the emotional needs of our pets 38:03 – Josh’s learning process through these theses 38:34 – Popplet 45:49 – Investors that Josh has learned the most from 47:37 – Josh’s comfort investing outside of his usual asset class 49:03 – @wolfejosh 50:56 – What is the thinking with the short strategy at Lux 52:31 – SpaceX vs Tesla, good business vs bad business 53:42 – How Josh approaches the quality of a business 54:15 – World After Capital 55:16 – How does Josh evaluate competitive advantage 56:45 – Where are we in the venture capital landscape 1:01:42 – How does his outlook on venture capital affect the way Lux is run 1:02:48 – Thoughts on cryptocurrency 1:07:22 – What is the most memorable conversation Josh has ever had 1:09:34 – What is Josh’s objective function in life 1:12:43 – Are there people that Josh disagrees with but deeply respects 1:13:32 – Kindest thing anyone has ever done for Josh Learn More For more episodes go to InvestorFieldGuide.com/podcast. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub Follow Patrick on twitter at @patrick_oshag

-

Harvey Sawikin - Emerging Market Opportunities

Harvey Sawikin - Emerging Market OpportunitiesFrom 🇺🇸 Invest Like the Best with Patrick O'Shaughnessy, published at 2018-02-06 10:30

My guest this week is Harvey Sawikin, a co-founder and lead portfolio manager at Firebird Management, which manages funds dedicated to investing in emerging market equities. Emerging markets are often a blind spot for investors of all types: most of us have never traveled to the far east or eastern Europe, where many of the thousands of emerging market public equities operate. I’ve been very lucky to travel quite a bit in Asia and the Middle East, but never to eastern Europe, which where Firebird focuses its investments. Harvey and I discuss his 24 years of experience evaluating emerging and frontier market countries, industries, and individual stocks. We discuss his experience buying privatization vouchers in Russia, banks in the Baltics, and how today’s emerging market opportunity set compares to the past. Like so many of these conversations with investors who have earned significant excess returns, its clear investing opportunities in emerging markets are often disguised. Finding them requires risk, hard work, discipline, and a dose of luck and timing. Please enjoy my conversation with Harvey on Emerging Market Opportunities. For more episodes go to InvestorFieldGuide.com/podcast. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub. Follow Patrick on Twitter at @patrick_oshag Links Referenced Via Books Referenced The Intelligent Investor: The Definitive Book on Value Investing. A Book of Practical Counsel Education of Rick Green, Esquire Show Notes 2:26 – (First Question) – Most memorable travel experience since the beginning of Firebird 5:41 - How Harvey got interested in emerging markets investing, specifically, Eastern Europe and Russia 10:00 – How does the landscape for emerging markets today compare to when he first started 12:30 – What are the factors of an emerging market to look at and why do some not pan out 15:04 – Do countries have to meet minimum criteria before Harvey and his team will even start to do work on an emerging market 17:33 – How does Harvey distinguish between frontier and emerging markets 18:37 – Thoughts on the access points that regular investors have into emerging markets, such as ETF’s and Mutual Funds 23:48 – How does Harvey think about risk exposure when constructing a portfolio 25:56 – Looking at the bottom up part of the equation, what factors within a company or sector are considered as part of the investing decision 31:05 – Dividends in emerging markets 33:09 – How do US equities stack up as an investment against fixed income 34:53 - The Intelligent Investor: The Definitive Book on Value Investing. A Book of Practical Counsel 36:52 - How do US equities stack up as an investment against emerging markets 39:38 – What type of investor allocate funds to emerging markets 42:37 – The value of travel in understanding emerging markets 50:19 – Biggest mistakes that emerging market investors make 54:49 – What in today’s markets has the smell of opportunity 55:53 – Harvey’s interest in Via 56:58 – Interest in buying gold coins 1:00:05 – If Harvey could only choose one country to visit, business or pleasure, where would he go 1:01:09 – Kindest thing anyone has done for Harvey 1:01:38 – Education of Rick Green, Esquire Learn More For more episodes go to InvestorFieldGuide.com/podcast. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub Follow Patrick on twitter at @patrick_oshag

-

Anthony Pompliano - Full Tilt Investing

Anthony Pompliano - Full Tilt InvestingFrom 🇺🇸 Invest Like the Best with Patrick O'Shaughnessy, published at 2018-01-30 10:30

My guest this week is Anthony Pompliano. Pomp began his career in the military, and has since been a successful entrepreneur, worked as a head of growth at Facebook, and started Full Tilt Capital, an early stage investing firm in North Carolina. This conversation has three memorable sections. Early on, we discuss the four traits Pomp looks for in founders, which we cover in detail. These double as traits that are important when hiring anyone. Next, we discuss his unique take on cryptocurrencies, where he is excited about the prospects for tokenized securities. Finally, we explore a unique media company, Bar Stool Sports, and what makes it such a powerful brand. Please enjoy our somewhat abbreviated discussion and know we will continue the conversation soon. For more episodes go to InvestorFieldGuide.com/podcast. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub. Follow Patrick on Twitter at @patrick_oshag Links Referenced Dave Portnoy and Barstool Sports’ Secret Billion Dollar Plan Books Referenced Win Bigly: Persuasion in a World Where Facts Don't Matter Show Notes 2:06 - (First Question) – Recap of Anthony’s military career 4:07 – Most memorable experience while deployed 5:27 – Transition out of the military and how it shaped his investing philosophy 11:19 – investing philosophy of Full Tilt, starting with deal economics 10:00 – Attributes of an ideal founder 13:50 - Where you actual learn the attributes that make you a good founder 14:40 – Time that Anthony has taken the biggest risk in life 16:45 – What is the viewpoint that Full Tilt has today that gives it Alpha in the market 18:47 – Why tokenized securities could be advantageous for investors in a company 19:51 – Anthony’s explanation of a tokenized security and what needs to happen for this idea to be fully realized in the market 22:22 – What could be the impact on the markets of making liquidity in venture so readily available 24:39 – What are tokenized securities actually invested in in the real world 27:42 – What does Anthony think about the commodity risk 29:04 – Describing Standard American Mining, a company they incubated 29:58 – Exploring the shift from a CPU world to a GPU world 31:49 – Getting involved in places where we haven’t caught up with the rest of the world 33:05 – Anthony’s interest in Barstool Sports 33:11 – Dave Portnoy and Barstool Sports’ Secret Billion Dollar Plan 37:09 – Win Bigly: Persuasion in a World Where Facts Don't Matter 39:02 – What lessons from Full Tilt world would Anthony share with others in the more traditional business world 40:35 – Kindest thing anyone has done for Anthony Learn More For more episodes go to InvestorFieldGuide.com/podcast. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub Follow Patrick on twitter at @patrick_oshag

-

Dr. Ben Hunt - The Three-Body Portfolio

Dr. Ben Hunt - The Three-Body PortfolioFrom 🇺🇸 Invest Like the Best with Patrick O'Shaughnessy, published at 2018-01-23 10:30

My guest this week is Dr. Ben Hunt, the chief investment strategist at Salient and the author of the extremely popular epsilon theory. I’ve always enjoyed Ben’s writing style, particularly his use of farm and animal based analogies to describe market phenomenon. In this conversation, we discuss his recent post the three body problem, why growth has been beating value, and why a strategy that he calls profound agnosticism—a take on risk parity—may be the most appropriate investing strategy in what he views as a very uncertain world. We also discuss some of his favorite lessons from the farm. Please enjoy our conversation! For more episodes go to InvestorFieldGuide.com/podcast. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub. Follow Patrick on Twitter at @patrick_oshag Links Referenced The Three-Body Problem Show Notes 1:54 - (First Question) – Applying the three-body problem to investing 7:24 – Fundamental view of investing, Profound Agnosticism 8:24 – Why has value done so poorly relative to growth in this framework 11:01 - Ben’s thoughts on why value has been underperforming for so long 13:52 – Investors should be able to adapt 17:49 – Thoughts on the risk parity approach 23:23 – Ben’s strategy for working with several teams 26:48 – What’s the best way to gain an edge, top down factors vs company/bond individual analysis 28:29 – How do you measure risk amid the large amount of uncertainty that exists in markets 32:40 – How does Ben personally think about investing 34:41 – Ben’s farm and the investing lessons learned by some of the animals 39:55 – How bees can plan out their entire work structure by the angle of the sun 42:58 – Defining basis risk 44:59 – Personal risk vs portfolio risk 49:30 – The concept of fingernail clean and our perception of what eggs are 53:57 – How ETFs are like mass produced eggs 54:56 – Exploring the idea of quality vs scaling 58:39 – What is the current challenge/puzzle that Ben is focused on right now 1:01:59 – What is Ben looking for when looking into game theory and applying it to the words that are published and spoken about investing 1:03:57 – Most memorable day on Ben’s farm 1:05:04 – Kindest thing anyone has done for Ben Learn More For more episodes go to InvestorFieldGuide.com/podcast. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub Follow Patrick on twitter at @patrick_oshag

-

Preston Byrne - Crypto-pocalypse

Preston Byrne - Crypto-pocalypseFrom 🇺🇸 Invest Like the Best with Patrick O'Shaughnessy, published at 2018-01-16 10:30

My guest this week is Preston Byrne. Preston is vocal critic of crazy prices and projects in the world cryptocurrencies. His background is in the legal world and also as a founder and former COO of Monax, which made the first open-source permissioned blockchain client. As Preston says, he is a “blockchain without bitcoin” guy, who believes that this crypto mania will end in some sort of apocalypse for token holders and ICO issuers . We tackle several issues, from his broad skepticism of crypto assets, to the potential regulatory reaction from major governments, to types of coins like stable coins, which Preston views as analogous to perpetual motion machines. Please enjoy our conversation and for any crypto investors out there, let me know if this conversation affects your opinion of the investing prospects for cryptocurrencies. Hash Power is presented by Fidelity Investments For more episodes go to InvestorFieldGuide.com/podcast. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub. Follow Patrick on Twitter at @patrick_oshag Links Referenced Bitcoin white paper The Bear Case for Crypto Hash Power series Zero Hedge Preston tweet on Reverse network effect Show Notes 2:12 - (First Question) –Ponzi scheme vs pyramid scheme vs Nakimoto scheme 5:29 – Why there are regulatory challenges to cryptocurrency 5:33 – The Bear Case for Crypto 9:59 – Who are the most influential people supporting this and how are they swaying the regulatory minefield on this issue 10:28 – Hash Power series 13:23 – Looking into the idea of a digital asset and the difference between blockchain and the token itself 16:09 – What about the idea that cryptocurrency’s only feature is that it’s censorship resistant 18:39 – Why cryptocurrencies become less usable the more successful they are 18:59 – Zero Hedge 21:04 – Why can’t we rely on offchain solutions to solve the scaling issue 22:29 – The idea of bubbles and what happens next in this one 25:41 – What are the incentives to build technology to support cryptocurrencies 29:23 – Explaining Ripple 31:21 – What would precipitate a massive reversal in the inflated valuations of cryptocurrencies 34:52 – Understanding reverse network effects 34:36 – Preston tweet on Reverse network effect 37:45 – The principles behind Stablecoin 42:20 – What has been the greatest lesson that Preston has learned about blockchain he wish he knew when he first got started 44:05 – How embedded will blockchain be by 2024/2025 45:12 – ICO’s, why Preston is not a fan and if there are any positives to them 50:20 – What are the conditions under which these things will be viewed legally. 54:00 – Preston’s history owning cryptocurrencies 55:35 – What has Preston most excited in the space 59:02 – Utility settlement coin 1:00:36 – Why the fascination with marmots 1:02:10 – What to reference before getting started with cryptocurrencies 1:04:03 – Understanding supply chains in block chain 1:07:14 – Some smart people on block chain to follow 1:08:24 – Kindest thing anyone has done for Preston Learn More For more episodes go to InvestorFieldGuide.com/podcast. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub Follow Patrick on twitter at @patrick_oshag

-

Ali Hamed – Creative Investing

Ali Hamed – Creative InvestingFrom 🇺🇸 Invest Like the Best with Patrick O'Shaughnessy, published at 2018-01-09 10:30

I have a special request this week: share this episode with every curious person in your life. The conversation, with a 26-year old investor named Ali Hamed, serves as an example of what’s possible when you think creatively. Ali views the world with a fresh set of eyes, and has already become an expert at identifying new investment opportunities where others have not. As the second prodigy 26 year old in as many weeks on the podcast, these young guns are making me feel like an ancient 32 year old. We talk a lot about “alpha” in our world, earning returns better than the market. But the key word in that last sentence isn’t alpha, it’s earning. Hopefully you, like me, will use this conversation as a reminder of what it takes to earn differentiated returns. It’s not just the hard work, but also the mindset. We explore many examples of how to create new investment opportunities, from rolling up Instagram accounts, to financing perishable fruit like watermelons, to heavy machinery software. Please enjoy this special conversation with Ali Hamed. Follow him and his partners. And then go figure out how to earn success yourself in whatever it is you do by helping other people solve problems with empathy. For more episodes go to InvestorFieldGuide.com/podcast. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub. Follow Patrick on Twitter at @patrick_oshag Books Referenced The Big Short: Inside the Doomsday Machine Links Referenced Sheel Tyle Podcast Seed Investing is a B2C Business, While Growth Stage investing is a B2B Business Ira Judelson podcast Free Content and Digital Media Are Increasing Socio-Economic Disparity Show Notes 2:24 - (First Question) Ali’s investment philosophy 3:33 – History of Coventure and its unique structure 6:30 – The story of how Coventure was seeded 12:29 – What makes cost of capital such an interesting topic for Ali 14:13 – Exploring fee structures and the expectations for return in the current environment 17:02 – The current state of the VC world 21:42 – Ali’s investment process on the VC side 25:32 – What other requirements are there for Ali to make a VC investment 28:00 – Understanding the difference between judgement and empathy in founders 28:20 – The Big Short: Inside the Doomsday Machine 29:47 – Dealing with LP’s 32:47 – Sheel Tyle Podcast 33:39 – At one point did Ali feel the most personally at risk in his career 37:55 – Why did they get involved in cryptocurrency 43:30 – What excites Ali most about crypto 46:09 – Lending as an alternative way to invest in businesses 48:09 – An overview of their lending business 50:21 – How does deal flow and sourcing work in these arrangements 52:54 – How much encroachment will Ali face from competitors 54:28 – Exploring the idea of valuing and buying digital accounts 59:36 – How Ali thinks about marketing for his own firm and the ones he invests in 1:00:06 – Seed Investing is a B2C Business, While Growth Stage investing is a B2B Business 1:03:59 – Longer term aspirations for Ali and industries that he would avoid 1:04:25 – Ira Judelson podcast 1:08:05 – Ali’s view on the potential negative impact of free content 1:08:19 - Free Content and Digital Media Are Increasing Socio-Economic Disparity 1:12:48 – Kindest thing anyone has done for Ali Learn More For more episodes go to InvestorFieldGuide.com/podcast. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub Follow Patrick on twitter at @patrick_oshag

-

Sheel Tyle - The Future of Venture Capital

Sheel Tyle - The Future of Venture CapitalFrom 🇺🇸 Invest Like the Best with Patrick O'Shaughnessy, published at 2018-01-02 10:30

My guest this week is Sheel Tyle, who at just 26 years old has already had a successful career in venture capital. His most recent stint was as the co-head of the seed investing business at NEA, the largest venture capital firm in the world, where Sheel was also a partner. Now, Sheel has set off on his own, setting up his own firm called Amplo and having recently raised a $100M venture fund where he is the sole general partner. He aims to invest with young, mission driven entrepreneurs with a global focus. As you can tell from this resume, which also includes a degree from Stanford and a law degree from Harvard, this is one ambitious guy. There are several aspects of this conversation that will really stick with me, specifically his points on networking and the smartest decision that he’s seen entrepreneurs make. I also loved our discussion of some of the same trends we explored last week with Chris Dixon—topics like drones, automated cars, and blockchain, where Sheel often has a different take than the consensus. Please enjoy my conversation on Africa, entrepreneurship, venture capital trends, technology, and more with Sheel Tyle. For more episodes go to InvestorFieldGuide.com/podcast. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub. Follow Patrick on Twitter at @patrick_oshag Books Referenced Originals: How Non-Conformists Move the World Links Referenced Andela OneConcern Andy Rachleff Podcast Episode Mark43 TechCrunch VentureBeat Bill Draper (author) Show Notes 2:20 - (First Question) Sheel’s upbringing and how it shaped his interest in Africa 4:43 – The outlook for Africa 6:10 – Primary differences in valuations and momentum in Africa vs opportunities in other places which Sheel conveys through the story of Andela 10:45 – The perspective returns of venture capital investments 15:16 – Does the hyperfroth in ICO’s serve as a threat to traditional venture capital 17:53 – Where Sheel falls on the importance of networking in terms of his venture capital interests 20:38 – The stronger impact of a smaller, more tight-knit network 22:46 – Sheel’s feelings on driverless cars and the timeline for this sector 27:17 – What are the positive side effects of driverless cars taking over 29:01 – What is the best way to invest in driverless cars from a venture capital standpoint 31:30 – Sheel’s overrated/underrated take on different technology spaces 31:30 – VR/AR 32:21 – Blockchain 32:54 – Machine learning/AI 33:41 – Drones 34:53 – Other categories that we should be thinking about 36:54 – OneConcern 38:21 – Should entrepreneurs be raising more money over future liquidity concerns of the venture capital markets 39:40 – What are the places that Sheel can help a founder in the early stage formation of the company 40:02 – Andy Rachleff Podcast Episode 42:53 – What does the breakdown of domestic vs international investments potentially look like in fund 1 for Sheel 44:53 – Sheel’s most memorable travel experience 47:34 – what is the best decision Sheel saw a founder make 48:10 – Mark43 50:31 – Resources for people interested in venture capital 51:06 – TechCrunch 51:07 – VentureBeat 51:17 – Bill Draper (author) 51:25 – Originals: How Non-Conformists Move the World Learn More For more episodes go to InvestorFieldGuide.com/podcast. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub Follow Patrick on twitter at @patrick_oshag

-

Chris Dixon – The Future of Tech

Chris Dixon – The Future of TechFrom 🇺🇸 Invest Like the Best with Patrick O'Shaughnessy, published at 2017-12-26 10:30

My guest this week is Chris Dixon, who has written some of my favorite essays on technology and venture investing. Chris is a prolific investor and thinker, having been an entrepreneur, angel investor, and now partner at the well-known venture capital firm Andreessen Horowitz. Our conversation focuses on major trends in technology, including cryptocurrencies and the future of autonomous vehicles and drones. Chris has a rule of thumb for technology trends: find out what smart people are working on during the weekend, and you’ll know what other will be doing years in the future. After surveying his old essays, it’s clear you use Chris’s writings as a similar litmus test. Hash Power is presented by Fidelity Investments Please enjoy this great conversation with Chris Dixon on the future of tech. For more episodes go to InvestorFieldGuide.com/podcast. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub. Follow Patrick on Twitter at @patrick_oshag Books Referenced Technological Revolutions and Financial Capital: The Dynamics of Bubbles and Golden Ages Who Controls the Internet?: Illusions of a Borderless World Links Referenced Douglas Hofstadter Daniel Dennett How Aristotle Created the Computer New Yorker Cover on automation The World of Numbers website Jerry Neumann podcast episode David Tisch podcast ERC-20 Token Standard Eleven Reasons To Be Excited About The Future of Technology Show Notes 2:04 (First Question) – Why did Chris choose to study philosophy 2:23 – Douglas Hofstadter 2:24 – Daniel Dennett 3:20 – How Aristotle Created the Computer 3:35 – Where has his thinking and viewpoints changed the most having been in the real world 4:42 – What is the real driving force behind all of the technology that we are creating and will automation kill all of the jobs 6:16 – New Yorker Cover on automation 6:57 – The World of Numbers website 8:36 – A look at his history in networks and network design 11:03 – Technological Revolutions and Financial Capital: The Dynamics of Bubbles and Golden Ages 11:07 – Jerry Neumann podcast episode 12:32 – Who Controls the Internet?: Illusions of a Borderless World 13:06 – What are the market and technological forces that make it difficult to regulate software hardware companies 14:39 – The best features of proprietary centralized networks and open networks 16:40 – What things are better centralized vs decentralized 22:30 – David Tisch podcast 23:03 – When it comes to cryptocurrencies, what are the concerns that the protocols themselves hold value and could this lead to centralization of the system problems 24:02 – Block size debate (topic) 26:40 – ERC-20 Token Standard 27:23 – Is the blockchain the answer to the stagnation of the big tech players 34:39 - How does Chris think about the dichotomy of investing in people vs technologies 34:59 – Eleven Reasons To Be Excited About The Future of Technology 37:45 – What organizational structures of companies are most compelling 41:50 – Any major trends in technology a cause for concern for Chris 44:09 – What major trends is Chris passionately pursuing 51:15 – If everyone agrees on a future trend of technology, can you still make money investing in them 52:20 – How do you encourage younger people to approach the world and a career differently in this ever-changing world 57:39 – Kindest thing anyone has done for Chris Learn More For more episodes go to InvestorFieldGuide.com/podcast. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub Follow Patrick on twitter at @patrick_oshag

-

Sorin Capital – Retail Contrarians

Sorin Capital – Retail ContrariansFrom 🇺🇸 Invest Like the Best with Patrick O'Shaughnessy, published at 2017-12-19 10:30

So far I’ve spent no time in the podcast discussing real estate, so I was excited to get the chance to talk to the team at Sorin Capital, a billion dollar hedge fund which specializes in commercial real estate, REITs, and commercial mortgage backed securities. Sorin is lead by Jim Higgins, who founded the firm, and Tom Digan, who coincidentally was a college classmate of mine at Notre Dame. You’ve probably heard me joke that this podcast should be called “This is who you are up against,” and this episode is a good example. I always enjoy exploring a niche part of the market, and this conversation on real estate is a perfect example of the type of work that firms do on behalf of their clients. Please enjoy my conversation with the team from Sorin Capital. Show Notes 2:43 - (First Question) –Outline the Real Estate Investment Trust world and what the assets and total value look like 6:10 – What does the profile of investors in the space look like compared to investors in the broader debt markets 9:43 – What are the characteristics of a liquid real estate portfolio that make them so attractive to investors 10:54 – Looking at the history of Sorin Capital and how the business has evolved to where it is today 12:35 – Understanding the idea of securitization of commercial mortgages 17:01 – What really led to the formation of Sorin after working for Bear Stearns 20:19 – Looking at the retail sector in real estate in the scope of actual trades that are being made 25:08 – From an investing standpoint, how do you craft a portfolio that takes advantage of the real estate space as retail appears to be suffering on the surface 30:09 – The different type of real estate investments in the retail sectors and what piece of the pie do they make up 32:43 – How does the business model of the mall work and why is it so connected to the department stores 34:08 – What is the future of malls itself with the big changes happening to the legacy stores that helped them proliferate 37:44 – Why won’t the same thing that has happened to apparel stretched to all sectors of the retail industry 39:09 – How do they search for inefficiencies in the market 41:20 – One of the craziest things they saw on the road that outlined real world craziness in real estate investment 42:23 – What is the duration involved in these types of investments 44:41 – How the portfolio is positioned across these different real estate types 47:49 – Why haven’t others come in and taken advantage of the investments that Sorin is able to 49:03 – Reaction to the idea that the growth of passive ETF’s and investing styles has lengthened the time over which certain inefficiencies would be corrected and are distorting things 51:27 – How much does momentum play into their thinking 54:19 – How evenly distributed are the vintages of these ten year cycles 57:15 – Explaining the idea of deep value bottom up work in the real estate investment world that they have done a deep dive on 59:31 – Best stories from boots on the ground visits 1:04:04 – The origin story for the original Sorin partnership 1:04:42 – Ugly Americans: The True Story of the Ivy League Cowboys Who Raided the Asian Markets for Millions 1:04:43 - Liars Poker 1:04:44 – Barbarians at the Gate: The Fall of RJR Nabisco 1:07:51 – What was it like for Tom getting started and the lessons he learned after an incredible hard time for the market 1:09:24 – What was it like for Jim coming through the crisis 1:11:18 – What is the trend for funds to craft investments specific to investors vs having them buying products that they produce 1:18:29 = Are other hedge fund firms moving to a client demand or solutions-based model? Or are we still very early in the transition 1:22:50 – What would the generalists miss in this space vs someone like Sorin that is a specialist

-

Franklin Foer – World Without Mind

Franklin Foer – World Without MindFrom 🇺🇸 Invest Like the Best with Patrick O'Shaughnessy, published at 2017-12-12 10:30

My guest this week is Franklin Foer, the author the recently published book “World Without Mind.” The topic of our conversation is one that I’ve been thinking through often this past year: the impact that large technology companies have on our minds and behavior. This conversation is only indirectly related to markets, but given that the companies we discuss are now several of the largest by market cap in the global stock market, what happens to them likely impacts all of our portfolios whether we own them or not. Given that these companies compete for our attention and dollars, they also affect our businesses. As an example, My friend Brent Beshore and his team at Adventures wrote a long and incredibly thoughtful piece on how they think about Amazon as a force in the market, and how they plan on navigating around such a fierce competitor. Franklin’s book, especially the early history, is very thought-provoking, so it was no surprise that our conversation was too. Please enjoy our talk on the tech giants. For more episodes go to InvestorFieldGuide.com/podcast. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub. Follow Patrick on Twitter at @patrick_oshag Links Referenced Free PDF of The Whole Earth Catalog Amazon Must Be Stopped (New Republic) Hannah Arendt Philosophy Time Well Spent Books Referenced World Without Mind: The Existential Threat of Big Tech The Whole Earth Catalog The Lessons of History Show Notes 1:40 - (First Question) – As part of Jonathan’s new book, World Without Mind: The Existential Threat of Big Tech, exploring the idea of the whole earth catalogue. 4:09 – The Whole Earth Catalog 4:36 – Free PDF of The Whole Earth Catalog 4:49 – What happened next for Brand and how he laid the early groundwork for today’s modern Silicon Valley 7:43 – Franklin’s personal journey into writing this book 10:00 – Amazon Must Be Stopped (New Republic) 11:48 – Thoughts on the advancement of technology in our world 15:52 - Filling the gap into Brand’s influence on Silicon Valley from the early 80’s to today 18:57 – How does the current state of the free internet without gatekeepers hold up for the next generation 20:53 – Is there a chance that technology’s unlimited mining of our attention is not the horrible thing we often make it out to be 24:47 – What are the ways we can have a free internet and other technologies, but not let them get perverted 28:09 – How will people respond to our tech monopolies 31:54 – The Lessons of History and the rise and fall of centrist powers 33:02 - A look at Franklin’s work and how its impacted by the reliant on a few large tech companies 35:28 – The dangers that tech giants like Facebook, Amazon, etc, have created for us 40:45 – Is there a technology, company, or trend that Franklin is really excited for 42:19 – Will there be movements that emphasis detachment from technology 44:05 – Why most innovations have happened to people thinking in a very separated or contemplative mode 45:58 – What’s the most exciting thing that Franklin is thinking about now 49:30 – What was the most memorable content in researching this book that Franklin would suggest other check out 49:59 – Hannah Arendt Philosophy 52:37 – Are there specific things that Franklin does to be more contemplative 53:26 – Time Well Spent 54:47 – Kindest thing anyone has done for Franklin Learn More For more episodes go to InvestorFieldGuide.com/podcast. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub Follow Patrick on twitter at @patrick_oshag

-

Adam Ludwin - A Sober View on Crypto

Adam Ludwin - A Sober View on CryptoFrom 🇺🇸 Invest Like the Best with Patrick O'Shaughnessy, published at 2017-12-05 10:30

My guest this week is Adam Ludwin, the founder and CEO of Chain, a blockchain technology company targeted at large enterprises. Before shifting his career to focus solely on crypto, Adam was a venture capitalist focused on FinTech, which is how he came across the Bitcoin whitepaper earlier than most. I called this episode “a Sober View on Crypto” because Adam’s take is so balanced. He is certainly long crypto, both in his portfolio and career, but he is very skeptical of much of what is happening in the ecosystem today. For example, he offers the best reason I’ve heard for not launching an ICO or investing in them. If you haven’t read Adam’s widely shared open letter to Jamie Dimon, it has become a must-read piece for crypto-enthusiasts. Read it as soon as you can. I edited out an earlier chunk of our conversation as it was largely introductory. If you need a broader introduction to cryptocurrencies, I suggest starting with episode one of Hash Power and working your way forward. One key insight from Adam in our offline discussion what how cryptocurrencies function very much like equities or bonds. Just as equity financing enables the activity of joint stock corporations, cryptocurrencies enable activity in decentralized applications. We pick up our discussion with Adam discussing whether anyone really uses these decentralized apps today. Hash Power is presented by Fidelity Investments For more episodes go to InvestorFieldGuide.com/podcast. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub. Follow Patrick on Twitter at @patrick_oshag Show Notes 2:35 - (First Question) – Will anyone use cryptocurrency in the real world at a large scale 3:43 – The idea of censorship resistance 12:29 – Will society be accepting of this technology 14:39 – Why decentralized apps can’t be acquired 18:24 – The idea of exponential vs linear improvements on a trend and if there are limits to the growth of decentralized technologies 23:26 – The struggle with early adaption of blockchain 25:41 – Best application for bitcoin, storing value 29:52 – Adam’s introduction to cryptoassets and how his thinking has evolved in the space 36:44 – In this hyper frothy market, is there a situation that makes an ICO exciting to Adam 43:51 – Even though it appears to be easy money, Adam explains why you shouldn’t just create an ICO 50:59 – A look at what Chain is doing and what Adam is excited about 53:23 – How does what Adam is working on help to improve the ledger of his clients 1:02:00 – Why you can easily be an early investor in crypto currency 1:04:27 – Kindest thing anyone has done for Adam Learn More For more episodes go to InvestorFieldGuide.com/podcast. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub Follow Patrick on twitter at @patrick_oshag

-

Joanne Wilson - Angel Investing and Trend Spotting

Joanne Wilson - Angel Investing and Trend SpottingFrom 🇺🇸 Invest Like the Best with Patrick O'Shaughnessy, published at 2017-11-28 10:30

My guest today is Joanne Wilson, a New York City based angel investor, writer, podcaster, trend spotter, and self-described “woman around town.” Joanne has had a multifaceted and winding career, and began angel investing a decade ago when she put money into NYC-based media company Curbed media which we discuss in detail. Since then, she’s invested in more than 90 companies and been pitched by countless more. She is an instantly likeable person, you can literally tell in 10 seconds you are going to have a great conversation, so it’s no surprise that part of what makes her unique among angels is a very close relationship with many of the founders she backs. We cover a lot of ground. We talk about the personality traits of entrepreneurs, Joanne’s evolving investment style, her focus on female founders, fashion, business models, restaurants and a lot more. Please my conversation with the Gotham Gal, Joanne Wilson. For more episodes go to InvestorFieldGuide.com/podcast. To get involved with Project Frontier, head to InvestorFieldGuide.com/frontier. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub. Follow Patrick on Twitter at @patrick_oshag Show Notes 2:12 - (First Question) – How does Joanne orient herself towards what’s new, in the context of food in New York city 4:10 – Can that mindset of forward thinking be cultivated 5:18 – Latest thing that got Joanne excited before everyone else 6:57 – Why the new frontier is going niche and local 10:23 – Joanne’s first investment 11:48 – Why do VC’s typically stay away from media 12:55 – How Joanne got into her first investment as a customer 14:11 – What is the skillset of making money that Joanne as 14:45 – Can you sense if a founder has that innate ability to just make money 17:04 – Are there common traits in founders 18:07 – Joanne’s progression into angel investing after her first investment 19:58 – Red flags when looking at investments 20:40 – Impression on growth without goals 23:30 – Trends among Joanne’s investments 25:56 – How much knowledge is transferrable between different industries that Joanne invests in 27:06 – The dichotomy and unique challenges between raising capital with female founders vs male founders 29:07 – How does Joanne balance her time and stay engaged with all of her investments 30:50 – Time when Joanne has helped a founder side step a pothole 31:35 – Most memorable first impression Joanne experienced 35:05 – How often does someone not have the right idea but is still worth investing in 37:19 – Why Joanne won’t start a fund 38:22 – Data on female founders returns and time 40:38 – Criteria for identifying emerging trends, especially in the more creative/artistic fields 43:29 – The changing costs of launching a brand, in the contest of fashion 47:11 – What has Joanne most excited right now 48:11 – Interesting facts about the fashion business 52:01 – Kindest thing anyone has done for Joanne Learn More For more episodes go to InvestorFieldGuide.com/podcast. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub Follow Patrick on twitter at @patrick_oshag

-

Connor Leonard - Capital Light Compounders & Reinvestment Moats

Connor Leonard - Capital Light Compounders & Reinvestment MoatsFrom 🇺🇸 Invest Like the Best with Patrick O'Shaughnessy, published at 2017-11-21 10:30

This week’s conversation is an ode to old school, fundamental public market investing. My conversation is with IMC’s Connor Leonard, who spends most waking hours thinking and reading about markets. His mandate is to invest purely as if it was his own money, with no pressure to hug a benchmark, and no pressure to do much of anything other than earn strong long-term returns. The portfolio that results from this approach is highly concentrated and unique. Connor’s strategy is to sort companies into four categories based on their type of sustainable competitive advantage. As you’ll hear, the vast majority fall into the first category, which means they don’t have such an advantage and therefore should be largely set aside. We spend the majority of our conversation talking about the other three categories: 1) companies with a legacy moat, 2) companies with a re-investment moat, and 3) an interesting category Connor calls “capital light compounders,” which we explore in detail. When you step back and think about public markets, you realize how amazing it is that we can, from afar, buy an interest in so many companies around the world. A select few go on to deliver outstanding returns. This conversation highlights how hard that can be, but also how fun and ultimately rewarding. Please enjoy my talk with Connor Leonard. For more episodes go to InvestorFieldGuide.com/podcast. To get involved with Project Frontier, head to InvestorFieldGuide.com/frontier. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub. Follow Patrick on Twitter at @patrick_oshag Books Referenced Margin of Safety: Risk-Averse Value Investing Strategies for the Thoughtful Investor The Outsiders: Eight Unconventional CEOs and Their Radically Rational Blueprint for Success Links Referenced Pat Dorsey Podcast Episode David Tisch podcast Will Thorndike Podcast episode Show Notes 2:31 - (First Question) – Trends in value investing 2:52 – Margin of Safety: Risk-Averse Value Investing Strategies for the Thoughtful Investor 4:43 – A look at Connor’s backstory and the history of IMC, parent company of Golden Corral 8:01 – Why Connor loves the public markets so much 9:21 – The concept of intrinsic value when looking at companies 12:36 – How Connor categorizes MOATS 13:21 – Pat Dorsey Podcast Episode 14:27 – Legacy MOATS 16:11 – Reinvestment MOATS 17:58 – Capital light compounder MOAT 20:00 – Why classifieds are an interesting business model 25:12 – Looking at platform businesses 26:56 – Looking at companies in the 500 million to 5 billion range and what makes it so enticing 30:34 – What is the process that gets Connor to find investment opportunities 35:53 – David Tisch podcast 36:15 – How Connor looks at industry classifications 41:30 – Connor’s strategy for running his portfolio 46:36 – The circumstances in which Conno would buy a legacy MOAT company 46:49 – Will Thorndike Podcast episode 46:51 – The Outsiders: Eight Unconventional CEOs and Their Radically Rational Blueprint for Success 49:21 – How do you pick managers that will beat the markets 52:21 – Second reason to buy a legacy MOAT 54:48 – Comparing the reinvestment MOAT and Capital A compounder in Connor’s portfolio 58:16 – Connor’s Mt Rushmore of Capital Allocators 1:00:03 – Impactful mentorships for Connor 1:01:52 – kindest thing anyone has done for Connor 103:04 – What in the discussion with founder of IMC got him the job Learn More For more episodes go to InvestorFieldGuide.com/podcast. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub Follow Patrick on twitter at @patrick_oshag

-

Dhani Jones - Adventures in Sports, Business, and Investing

Dhani Jones - Adventures in Sports, Business, and InvestingFrom 🇺🇸 Invest Like the Best with Patrick O'Shaughnessy, published at 2017-11-14 10:30

My guest this week is unique. As you will hear early and often, he is programmed to go his own way, to, as he says, go one way when everyone else is going another. His name is Dhani Jones, a name I knew as a Notre Dame football fan, because he won a championship with our arch-rivals, the University of Michigan, in the late 90’s. Dhani went on to a long and successful career in the NFL, but even more interesting has been his many pursuits in business and investing outside of football. Like my conversation with Tim Urban, I’ll remember this conversation as a reminder to use a first principles mindset. Dhani seems to have this fresh mindset baked into his character, and as you’ll hear this has led to many a great adventure. Please enjoy my conversation with athlete, businessman, investor, philanthropist, movie buff, and bowtie wearer, Dhani Jones. For more episodes go to InvestorFieldGuide.com/podcast. To get involved with Project Frontier, head to InvestorFieldGuide.com/frontier. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub. Follow Patrick on Twitter at @patrick_oshag Show Notes 1:30 - (First Question) – A introduction into Dhani Jones and everything he’s done 5:35 – How did Dhani change throughout his football career 9:55 – The power of your mind in every aspect of life 10:34 – Most memorable experience in the NFL 13:10 – Making the transition from the NFL to the business world 18:20 – Looking at Bowtie Cause 22:40 – The role of creative agencies in Dhani’s ventures and why story telling is so important for him 26:48 – Looking at some of the TV stuff that Dhani has done, particularly around travel 28:21 – Dhani’s favorite movie 30:35 – Back to the joy of travel and “Dhani Tackles the Globe.” 36:54 – How does Dhani think about risk 38:56 – Some of the other sports and activities Dhani did while filming his show 41:45 – The psychological benefit of travel in your personal and business life 44:41 – Looking into the business part of Dhani’s career 51:19 – How to expand diversity in the financial world 54:56 – Kindest thing anyone has done for Dhani Learn More For more episodes go to InvestorFieldGuide.com/podcast. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub Follow Patrick on twitter at @patrick_oshag

-

Chris Burniske - How to Value a Cryptoasset

Chris Burniske - How to Value a CryptoassetFrom 🇺🇸 Invest Like the Best with Patrick O'Shaughnessy, published at 2017-11-07 10:30

This episode is a continuation of the Hash Power series. It is the first of what we will call a Hash Power single—a series of conversations each with a single guest on a specific topic. In this case my guest is Chris Burniske, and the topic is cryptoasset valuation. This conversation is loaded with information, I think you are going to love it. Chris recently released book called Cryptoassets, which is a must read for those interested in this field. Chris was at one point the only tradintional buy side analyst covering bitcoin, and is now a partner at a new crypto firm called Placeholder. Chris has developed new frameworks for evaluating and valuing cryptocurrencies, marrying techniques and ways of thinking for several different asset classes to assess the newest asset class. Chris prefers the term cryptoassets because as you’ll hear, several of these tokens aren’t really currencies at all. We discuss the differences between cryptocurrencies, cryptocommodities, and cryptotokens. We begin our conversation with a deep dive into the equation of exchange, which Chris has been using as a starting point for understanding utility value. You can see all crypto related conversations at investorfieldguide.com/Hashpower. Please enjoy this conversation with Chris Burniske. Hash Power is presented by Fidelity Investments For more episodes go to InvestorFieldGuide.com/podcast. To get involved with Project Frontier, head to InvestorFieldGuide.com/frontier. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub. Follow Patrick on Twitter at @patrick_oshag Books Referenced Cryptoassets: The Innovative Investor's Guide to Bitcoin and Beyond Links Referenced Hash Power Podcast Documentary Nic Carter (twitter) Cryptoasset Valuations (Medium) Show Notes 4:58 - (First Question) – Chris’s overall method for evaluating cryptocurrencies 5:14– Cryptoassets: The Innovative Investor's Guide to Bitcoin and Beyond 6:47 – The equation exchange 11:19 – Bonding 12:35 – How bonding may represent a more efficient way of representing consensus over proof of work 14:29 – Why the amount being bonded and held should be taken out of the float 16:58 – Using bitcoin as an example to figure out remittances in the PQ side 18:31 – Looking at the velocity of various crypto-assets 21:04 – Chris’s impression of the different way of categorizing various crypto assets 24:37 – Explaining Auger as an example of a cryptotoken 25:38 – How could these networks be impacted by not having any censorship 27:57 – Exploring the gap between expectation vs reality in the value of crypto currency 30:43 – Other ways of valuing these crypto assets 30:50 – Hash Power Podcast Documentary 33:32 – Explaining the idea of billion dollar a day onchain transactions 36:05 – How to measure the value of the underlying network 36:37 – Nic Carter (twitter) 37:13 – What are the variables that matter when investing in cryptocurrency on a long-term horizon 39:24 – Determining when it’s better for a network to be centralized vs decentralized 42:03 – Networks that Chris is most excited about 44:06 – Understanding the consumption side of the steam marketplace 46:01 – Deep dive into the Aragon network 47:27 – How does Chris evaluate existential risk of networks 51:09 – Could these assets really ever go to zero? 54:07 – Is there a scenario in which velocity gets so high that it negatively effects the price 56:10 – What are the unknowns of cryptocurrency that Chris is most interested in 56:24 – Cryptoasset Valuations (Medium) Learn More For more episodes go to InvestorFieldGuide.com/podcast. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub Follow Patrick on twitter at @patrick_oshag

-

Brad Katsuyama - What Happens When You Hit “Buy”

Brad Katsuyama - What Happens When You Hit “Buy”From 🇺🇸 Invest Like the Best with Patrick O'Shaughnessy, published at 2017-10-31 09:30

My guest this week is Brad Katsuyama, the founder of the IEX exchange and protagonist of Michael Lewis’s famous book Flash Boys, which chronicled the role of high frequency trading in markets. This conversation was yet another reminder of how complicated markets can be, and that very few participants know all aspects of the process well. Brad and I get deep into the history behind his company, and the ways in which markets and exchanges have evolved, better or worse. One of my favorite parts of this conversation was our exploration of entrepreneurship. Brad’s whole story is one that entrepreneurs will appreciate, and is full of lessons for those aspiring to start their own business. Please enjoy my conversation with Brad Katsuyama For more episodes go to InvestorFieldGuide.com/podcast. To get involved with Project Frontier, head to InvestorFieldGuide.com/frontier. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub. Follow Patrick on Twitter at @patrick_oshag Books Referenced Flash Boys: A Wall Street Revolt Show Notes 2:10 – (First Question) Brad’s original discovery of a latency problem in trading stocks 12:51 – how the business model of the NASDAQ and exchanges and how it may surprise people 14:16 – The edge that exchanges are now monetizing 16:46 – How Brad went from finding a solution to his current firm 20:18 – Types of high frequency traders that there are 24:33 – The formation of IEX 27:56 – Funding IEX 30:48 – What happens to the initial funding 32:30 – Describe what IEX is as it was sold to early buy side investors 34:31 – Explaining the concept of a speedbump 38:18 – Pitching companies so they will be listed on their index 40:37 – Explains maker-taker fees 44:47 – The sources of revenue for IEX vs traditional exchanges 46:53 – Most memorable meeting Brad has had in establishing IEX 49:39 – How did he do this with young kids? 52:38 – Has the pool of potential profits that high-frequency trading firms can earn gone down 53:53 – What has Brad most excited about the future in terms of helping the buyside 55:17 – What was it like to see Brad’s venture get turned into a best-selling book. (Flash Boys: A Wall Street Revolt) 59:00 – Biggest thing that Brad has learned 1:00:56 – What would Brad do if he couldn’t work in the investing world. 1:02:25 - Kindest thing anyone has done for Brad Learn More For more episodes go to InvestorFieldGuide.com/podcast. Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub Follow Patrick on twitter at @patrick_oshag

-

Brett Maloley - Ladder: The Fitness Marketplace

Brett Maloley - Ladder: The Fitness MarketplaceFrom 🇺🇸 Invest Like the Best with Patrick O'Shaughnessy, published at 2017-10-24 09:30

This week’s episode is part of an experiment and so requires a longer than normal introduction. I’ve come to view this podcast as a learning tool, a means to understand a new topic in a short window of time. One of those areas is venture capital and startups—an area that one year ago was completely foreign to me. I think the best way to learn is aggressive immersion in a topic along with some consequences, what we often call some skin in the game. Accordingly, this is a conversation with the founder of a startup in which I am an investor. The founder is Brett Maloley and his company is called Ladder. Ladder represents an overlap of many topics we’ve explore together over the last year. We’ve talked about venture capital, health and wellbeing, the difficultly of fundraising and power law outcomes in startups. We also spent an entire episode, with Alex Moazed, talking about the business model that Ladder is pursing: what Alex calls platform business model and what my favorite technology writer Ben Thompson calls the Aggregator model. I hope you enjoy this collective experiment, which is largely the result of what I’ve learned from past guests and from all of your support which helps me meet those great people in the first place. Let’s dive in to my conversation with the founder of Ladder, Brett Maloley, who starts by describing how he got his start in the fitness world. Show Notes 5:25 – (First question) – Brett describes his history in the fitness industry 10:04 – Realized he could fix the commercial fitness industry by changing it 12:46 – Explain how Ladder works 14:14 – What does the ratio of digital to in-person coaching need to be in order to be effective coaching 17:12 – Explaining the platform business model as a whole and how to scale these types of business 22:15 – Origin of health clubs 24:01 – Current state of the health fitness space through some key stats 26:44 – What happened where gyms were able to start charging a lot less for memberships 30:20 – How Ladder is going to attract customers in the beginning 36:10 – How to drive engagement 37:46 – The opportunity for coaches on the platform 40:28 – How will ladder ensure the quality of coaches on the platform remains high 42:41 – Exploring the value of the data 45:32 – How will Ladder work with gyms in the scope of how a new business can take advantage of existing businesses 48:58 – Comparing Ladder to crossfit and what is not sustainable about 53:14 – Difference between a franchise model vs a license model 55:12 – Strategy for building an audience 59:56 – Competitors to this business 1:03:39 – Brett’s thoughts on brand broadly speaking and how he’s worked to shape Ladder’s brand 1:05:00 – Best individual experience of the platform so far