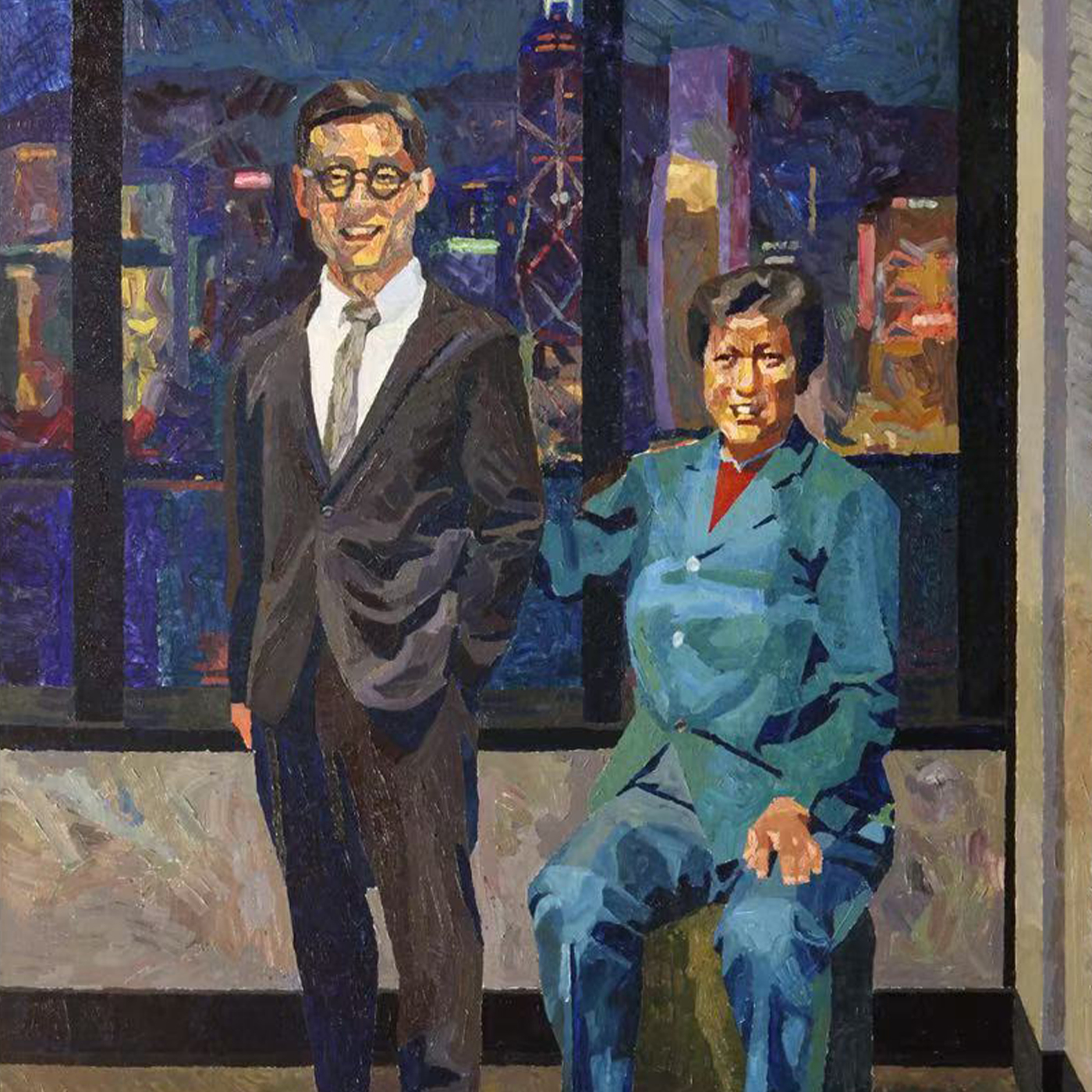

126. Talking with Sequoia's Zheng Qingsheng about: The flow revolution in economic history, the unpredictability of human behavior patterns, and founder personality

In previous episodes of our year-end review series, "Standing Beyond 2025," we featured the voices of Jinshajiang's Zhu Xiaohu, ZhenFund's Dai Yusen, and Altimeter Capital's Freda Duan. Today, we continue this series with Zheng Qingsheng, a partner at Sequoia China.Zheng Qingsheng offers a grander perspective – he extends the time horizon to 20 years, looking back at China's three waves of technological change, from the internet and mobile internet to AI. Furthermore, he places this perspective within a broader economic history, using the "traffic revolution" to seek clues for the next generation of to-C traffic nodes. Coincidentally, he entered the venture capital industry in 2005, making this his 20th year as an investor. Beyond his primary role as an investor, he is also a new product experience officer and an economic history enthusiast.Guest Profile02:00 Starting with learning programming in 198417:17 After becoming an investor in 2005: From Shanda Capital to Trust Bridge Partners and then Sequoia CapitalNew human behavior patterns are unpredictable19:09 The impact of Douban and Dianping on my investment career: I was deeply interested in them, as they explored cutting-edge human behavior patterns22:19 My impression of Ah Bei (Douban founder): "He and Douban are one"23:21 My impression of Zhang Tao (Dianping founder): "A more mature entrepreneur with keen product insights"23:55 Looking back now, Web 2.0 represented a wave of online content product innovation after humanity's first digitalization. Later, the sharing economy brought another large-scale innovation combining online and offline elements.24:31 China's venture capital over 20 years through the eyes of an economic history enthusiast: Before '05, after '10, after '15 (Pinterest's paradigm directly influenced subsequent content platforms)29:13 Looking back in history's rearview mirror: the birth, prosperity, and decline of various content platforms"Text is a high-level form of knowledge product""Rich media (images and text) tends to supersede text""Short video is a fundamental way for humans to understand the world""Ultimately, short video challenges text itself"34:10 Humans naturally evolve towards ways of understanding the world that don't require learning or long-term investment. Is AI also returning to this point?35:06 A personal perspective on Douyin, Xiaohongshu, Bilibili products and their founders"Bilibili's founder is more integral to their product, similar to Ah Bei""Xiaohongshu has the most open product structure I've ever seen"39:56 Summary: "New human behavior patterns are generally unpredictable"42:26 My personal investment aesthetics and reflections48:23 Why do apps like Xiaoyuzhou or podcasts emerge when we feel that C-side traffic has been fully captured?"Hearing is the only sense that can be used for multi-tasking"Traffic Revolution in Economic History50:51 Mobile internet C-side traffic culminated in short video; for many years after 2018 and 2019, there was a lack of major innovation, and to-C investment entered a dormant period.53:27 Traffic is a fulcrum in human economic history: Highways > Railways > Canals > Electricity > Wired Telephones > Television > Internet57:21 "You can think of all excellent internet to-C products today as a giant town"57:47 Artificial intelligence shows us the potential for new to-C traffic entry points.01:00:19 Differences: The networks formed in the AI era are not natural monopolies; their marginal costs do not approach zero; they are more results-oriented.01:04:34 AI has triggered deep digitalization, which I believe will bring new hardware opportunities. This could be another new traffic node beyond large models.01:09:53 Why haven't AI era products formed a two-sided network effect?01:12:20 The commercialization of AI products performs better than that of internet and mobile internet products.01:13:00 Having invested in Kimi, MiniMax, and Manus, do you think the ultimate value will reside in model companies or application companies?AI has bubbles? Just like the ocean has bubbles.01:18:24 Sequoia's systematic investment strategy in the AI era01:19:01 Sequoia's evolving aesthetic for founders01:19:45 I believe "track coverage" is a misunderstanding of Sequoia01:22:10 Agent startups vs App startups: Now it's born global01:23:50 Changes and pace in AI startups over the past three years01:24:40 Outlook and expectations for 202601:26:21 AI Bubble: "It's just like how there are bubbles in the ocean"01:28:39 Witnessing three traffic revolutions in human historyImagined Communities, Abstract Life, and Personified Representatives01:29:17 Observations on entrepreneurs from 0 to 1, 1 to 10, 10 to 100, and failed entrepreneurs"The CEO must become the personified symbol of the organization and its systems""Even if you can't achieve it, you must play the part""It's rare to have both talents: product sensitivity and embodying the persona of the organization and its team"01:32:05 CEO and MBTI01:35:20 Final rapid-fire Q&A;Year-end dialogue "Standing Beyond 2025":《122. Zhu Xiaohu's Third Installment of Realist Stories: The AI Feast and Bubble》《124. A Chat with Dai Yusen on 2026 Expectations, The Year of R, Correction, and How We Bet》《125. A Chat with Altimeter Partner Freda: Betting on OpenAI, Robinhood's Past, America's Capital Bad Boy, Abacus, and Bubbles》【More Information】Disclaimer: This content is not investment advice.

Original title: 126. 和红杉郑庆生聊:经济史的流量革命、人类行为模式的不可预期,与创始人性格

Original description: <figure><img src="https://image.xyzcdn.net/Flo18nNUSP7OUNlTf8UgCdHxio6O.jpg" /></figure><p>在前几集节目,我…